Radiation therapy at Elekta: The “Crawley Acquisition” of 1997

Important Turns, 1994 - 2005

Reading time: 10 minutes

Only months before the Asian crisis, Elekta bought the radiotherapy division from Philips. It was a huge acquisition and a significant change of strategy with lousy timing, but today linear accelerators are as essential as Gamma Knife for Elekta.

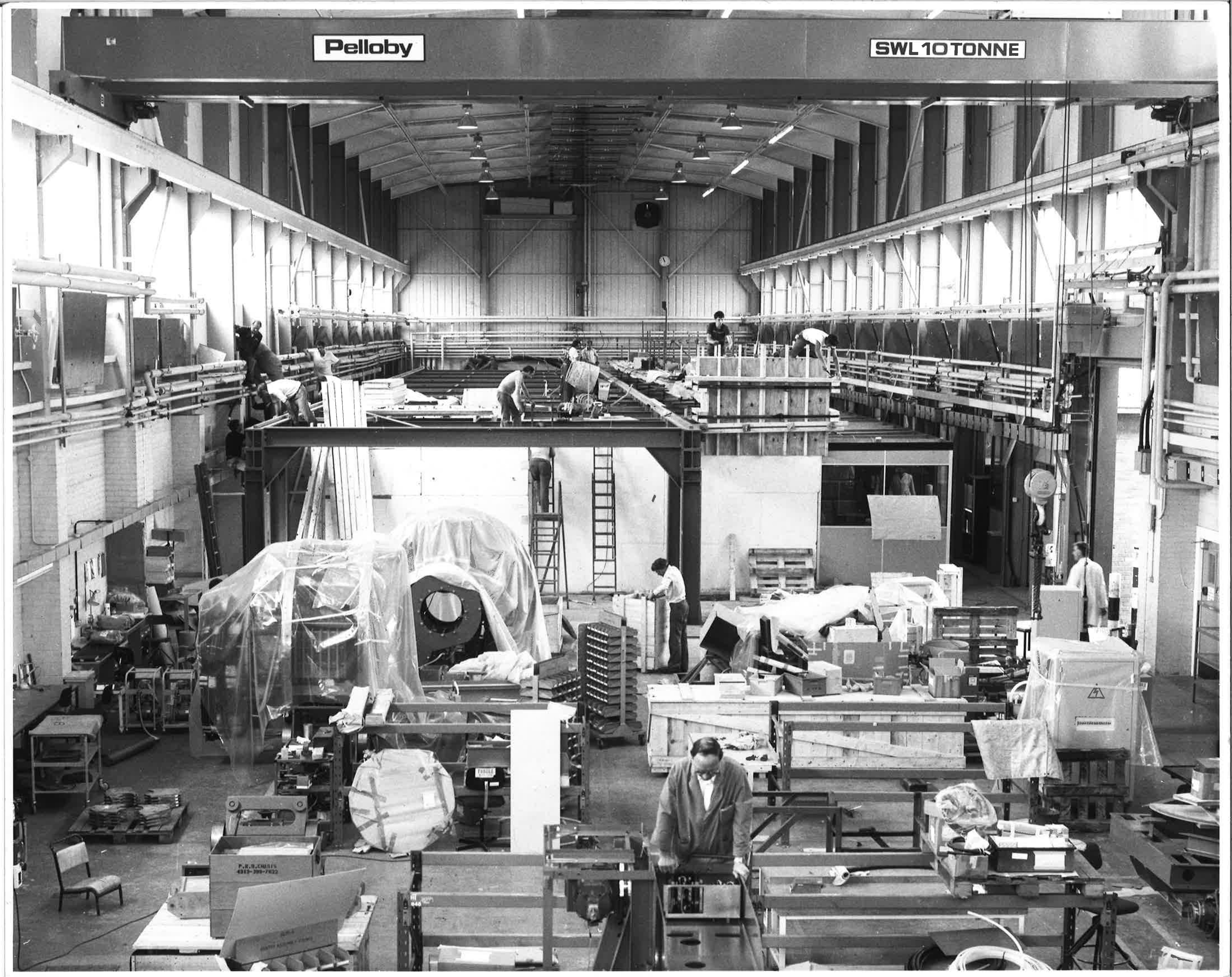

November 1996, Crawley, 28 miles south of London in the UK. The sky is grey, and it has been drizzling since the early morning hours. At Linac House on Fleming Way, the employees of Philips radiotherapy division have gathered for an announcement.

When they are told that Swedish company Elekta has signed a letter of intent to buy the unit from Philips, there is a moment of silence–and then relief. Although only a few had even heard of Elekta, they thought it had to be better than being an almost abandoned unit in the Dutch multinational conglomerate Philips Electronics.

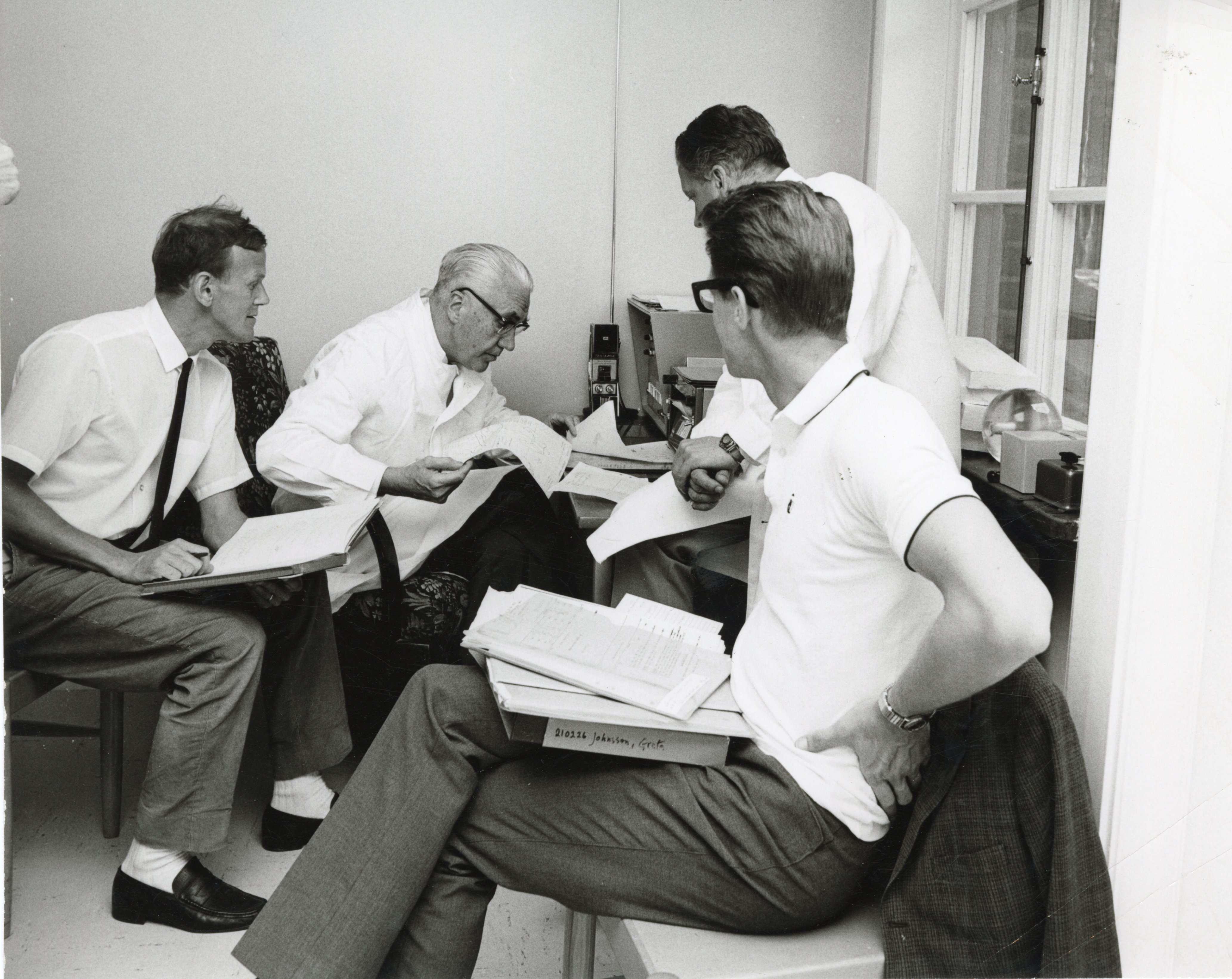

Dee Mathiesen, today senior vice president at Elekta and in charge of product quality, had been with the Philips radiotherapy division for nine years when it was acquired. She still remembers the meeting 25 years ago.

"When they said Elekta wanted to buy us from Philips, there were quite a few of us who looked at each other and said 'who'? I was one of them, I had no clue about the Gamma Knife or the Leksell family," she says.

Kevin Brown, today distinguished scientist at Elekta, says he saw new possibilities when he heard the news.

"I had been struggling with different issues around risk-taking and product development, and I thought that our, or my, mindset would be more aligned with the mindset of Elekta due to the similarity in products and customers."

Philips Medical System’s focus had been on diagnosing illnesses, which had led to a very “do-no-harm”-approach in all activities. Kevin Brown found this natural, but he also saw a possibility for the linac division to treat cancer more aggressively. That, of course, meant leaving the “diagnosis-only” field and moving into interventional treatments, with risk profiles that were the opposite of what Philips were used to.

Kevin Brown was also hoping Elekta would turn them into a Swedish company, as he had heard many positive things about the culture at the Stockholm office. Crawley was an odd bird in the Philips conglomerate. The division was part of Philips Medical System, but it was a mismatch because their products and customers were very different. The radiotherapy division had, at the time, a technologically advanced linear accelerator, but was hardly making any money.

Kevin Brown concludes that the deal was very logical. "Elekta wanted to expand beyond Gamma Knife radiosurgery and into radiation therapy, and Philips wanted to get rid of the radiotherapy division," he says.

Still, it was a significant change in strategy for Elekta, a complete 180-degree turn.

"For some, it was probably difficult to embrace, considering Elekta had spent the previous 20 years saying how inferior linear accelerators were compared to Gamma Knife," Kevin Brown says.

Philips' Radiotherapy division, with 900 people, was also a huge bite for the Swedish company to swallow. Elekta had only around 300 people employed at the time.

Nevertheless, in early 1997, Elekta acquired the radiotherapy business from Philips and paid approximately USD 60 million in cash and shares. The latter made Philips Electronics the second biggest shareholder of Elekta.

Elekta's journey to a new strategy

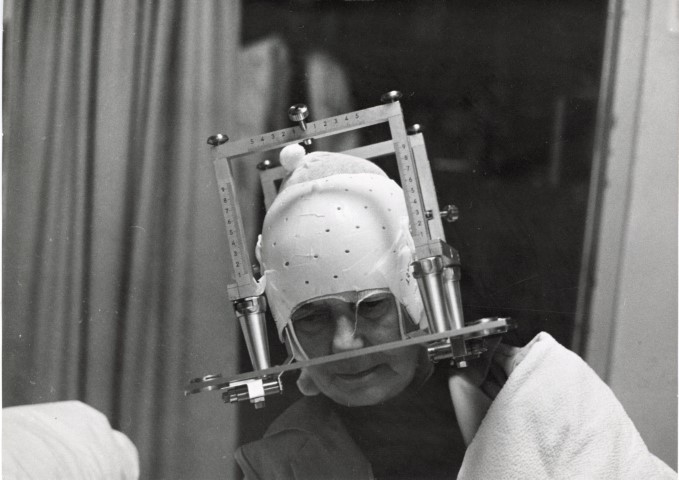

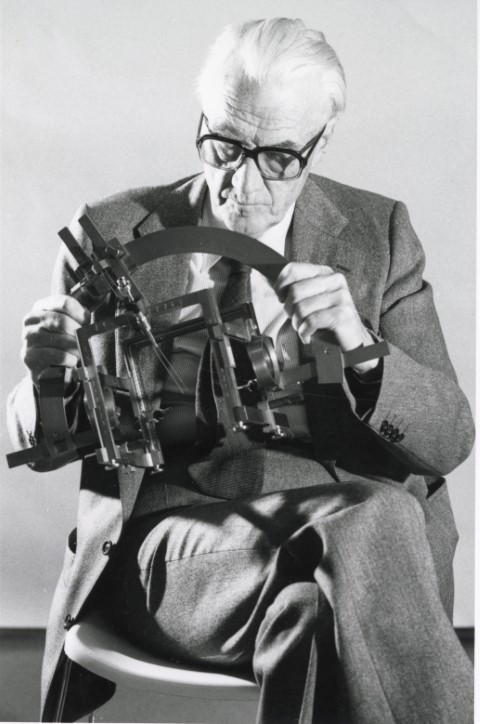

A few years earlier, in 1992, when Elekta had turned 20 years old, its portfolio held several stereotactic-related products, but the core offering was still Leksell Gamma Knife. It had only been five years since Elekta had made its first commercial sale in the USA, but things were moving in the right direction. It was time, however, to plan for the future, and those plans included thoughts of broadening the product portfolio. The company’s heritage was in treating diseases of the brain–and nothing more.

"No company wants to be a one-product-wonder. So, of course, that drove us to decide to go for the rest of the body," says Tomas Puusepp, at the time Vice President Neuroscience.

Even if Elekta was marketing Leksell Gamma Knife as a better and more efficient tool than traditional radiation therapy, they had closely followed the development and successes of the technology in recent years.

"We wanted to expand and work with the whole body, and we noticed that radiation as treatment for various forms of cancer had started to show very good results," Tomas Puusepp says.

Elekta realized it was time to leave the previous in-house development strategy and start looking at possible acquisitions. For that, capital was required, and Laurent (Larry) Leksell, founder and CEO at the time, also later said that he felt a responsibility towards the investors who previously helped him finance the company.

Elekta was listed on the Stockholm Stock Exchange in 1994—an effective tool for financing acquisitions—and the company quickly became a favorite among investors.

Two years later, in 1996, Larry Leksell was approached by Mike Mokley, head of Philips' Radiotherapy , X-ray, CT, and MRI imaging unit. Since the 1950s, they had also sold linacs for radiation treatment of cancer in all parts of the body. Was Elekta interested in acquiring the radiotherapy division?

The answer was yes. Elekta had already tried to buy Swedish-Swiss tech company ABB’s radiotherapy division but had lost the deal to competitor Varian. Elekta now saw promising opportunities to contribute to the development of even more efficient linacs as well as a need to avoid future competition against Gamma Knife.

In his biography “Radiant times” (“Strålande tider”) Larry Leksell writes: "It was an exciting opportunity, and accelerators targeting tumors by firing off charged particles could eventually threaten the Gamma Knife. So, better act before that happens. The board initially said no because of the size of the deal, but I convinced them."

According to Tomas Puusepp, Elekta had, before Mokley's call, already identified Philips’ linear accelerator as the technology of most interest for Elekta. Radiotherapy was still a blunt tool, but Elekta thought it knew how to develop it to deliver more precise treatment.

A short honeymoon

Initially, the stock market liked the acquisition of Philips’ radiotherapy division. Elekta was now considered a significant player in cancer treatment and the banks lined up to finance the growing business, but that would soon change.

Tomas Puusepp describes the opportunities that opened up with the acquisition but also the challenges that became clearer.

"Elekta was strong in neuro in the U.S. and Japan. Philips was strong in Europe. We had some common clients, but we also had some very different clients, so there were opportunities for cross-fertilization. Furthermore, we had geographical collaborations to ensure that we utilized our different customer bases and thus optimized sales."

But some things turned out differently than expected, Tomas Puusepp explains: "Crawley had good products and sold some, but the quality was poor. Even though they installed advanced equipment, they never managed to get them to work particularly well, which of course is crucial in the field of cancer."

It became evident that Elekta would have to invest much more into the Crawley operations than initially planned to lift quality levels. To head this division, Volker Stieber was recruited. He was an industry veteran with over 30 years at Siemens, where he had built their accelerator business. At the same time, Tomas Puusepp was made head of the neuroscience business.

Events on the world scene also affected the company. On July 2, 1997, after months of speculative pressures, Thailand devalued its currency relative to the U.S. dollar. This was the start of the Asian financial crisis that quickly spread to other countries and regions.

The crisis hit Elekta hard; almost half of the company's sales were in Asia. Furthermore, the company was already struggling to solve a significant overlap in Asia from the acquisition.

"When we bought the Crawley division, we had to take over a lot of people in Asia. It was a huge and expensive job and the Asian crisis made everything worse; it became a total disaster,” says Rolf Kjellström, at the time responsible for Elekta sales and marketing in Asia.

In his book, Larry Leksell also highlights a canceled large order from the U.S. and an import ban to China as contributing to the crisis Elekta found itself in.

Just before the turn of the millennium, Elekta's share price hit rock bottom, and the question of whether the company would even survive was impossible to avoid. In his book, Larry Leksell describes how he finally had one chance left to convince the bank to continue to financially support Elekta. He vividly explained how much the bank had to lose if the company went under–and the bank agreed to extend Elekta’s loans.

Elekta was not entirely through the crisis until 2000/2001, but by then the numbers started to point upwards again. When asked what they did to save Elekta, Larry Leksell later said: "We slimmed down our personnel, closed offices, sold property, and focused on the core business."

Tomas Puusepp says product development was crucial to the company’s recovery, and for where the company is today. "We stuck to what we wanted to achieve, and during these difficult years, we never cut back on research and development, we continued to invest large sums in the products that today are huge successes."

Still, it could easily have gone the other way, he admits. "Elekta was a bank loan away from surviving, and I remember those years as very difficult."

Today's linac

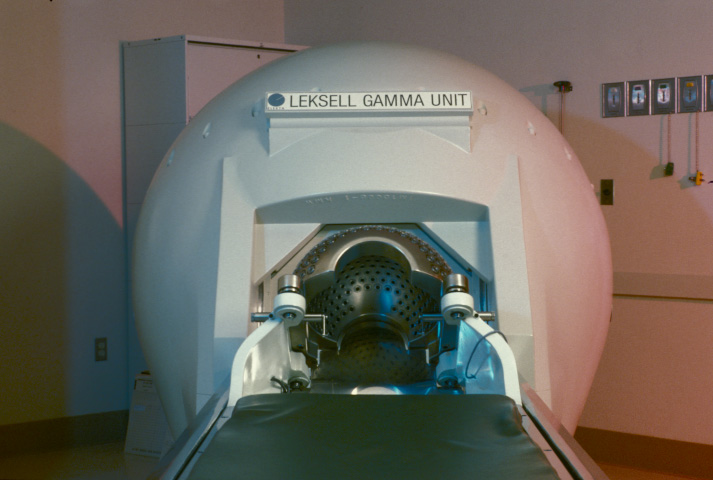

Soon, Elekta picked up momentum again. In Asia, particularly in Japan, Gamma Knife sales came back to life. The radiotherapy business was churning out products. Eventually, all the Philips legacy linac products were replaced by new designs developed by Elekta in Crawley.

The development of Elekta’s solutions during the 2000s, is described in more detail in other articles on this site as part of Our Story. But here are a few milestones.

In 2003, Elekta Synergy® was launched. It was the world's first system for image-guided radiation therapy (IGRT), built on integrating a linear accelerator with high-resolution x-ray imaging. But with an x-ray, you can only see bones, not soft tissue.

Another major milestone came when Elekta, in 2018, launched a linac that combined the capabilities of magnetic resonance imaging (MRI) with an advanced linear accelerator. This MR-Linac, called Elekta Unity, ensured the tumor and the surrounding organs were visible during treatment.

At the Elekta Capital Markets Day in 2021, the current CEO, Gustaf Salford, introduced the company's strategy, called ACCESS 2025. The strategy reflects the work the company will continue to do to pursue the vision of a world where everyone has access to the best cancer care.

"I want to see more than 300 million cancer patients gaining access to radiation therapy, an integral part of most cancer treatments. The identified clinical need for linacs globally is around twice the number of the current installed base (14,000 linacs), and the gap is largest in emerging markets," he explained to the capital market analysts.

An Elekta linac today could be described as more than a machine; it's a treatment device with radiation treatment planning, review software and quality assurance tools. And it is not a blunt tool anymore.

The facility where linacs are produced and developed is still located in Crawley, in the same building where the employees first heard of Swedish Elekta taking over their division. But now the division is far from abandoned.

Did you find it interesting?

Feel free to share it across social media!